Stock leverage calculator

Without knowing the margin requirement at different leverage ratios you might be throwing your entire account on one single position and if you are. If youre interested in stock investment and trading make sure to check out the earnings per share calculator too.

Margin Calculator Calculate Leverage Exposure For All Asset Classes

For example if a put has a delta of -070 and the stock goes up 1 in theory the price of the put will go down 070.

. Thanks to a decade-long credit binge driven by rock-bottom borrowing costs corporate debt as a percent of US. Add the preferred leverage. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water.

If the market value of a share is 1000 youll lose 95000. How to use Forex Calculator. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Set your account currency. Specify the leverage that you use for trading. If the strike price is 50 and the market value for the stock is 60 youll lose 1000.

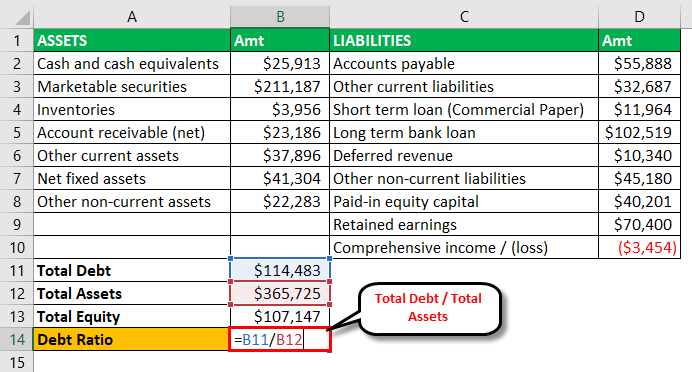

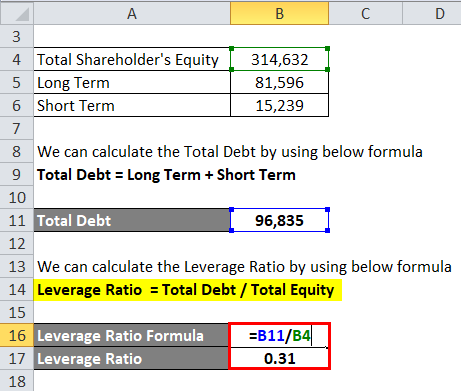

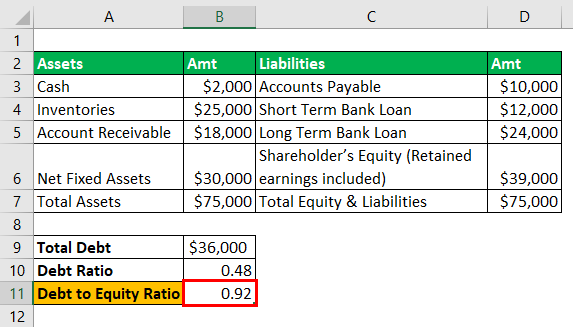

Businesses widely use leverage. The changing regulations by the Securities and Exchange Board of India SEBI that limit the amount of leverage a trader can get from a broker helped the Indian stock markets from a severe crash. Apple Inc Balance sheet Explanation.

Get 247 customer support help when you place a homework help service order with us. So in a nutshell this free stock calculator will show you. Hit Calculate After you click Calculate you will see the results below.

Stock brokers can accept securities as margin from clients only by way of pledge in the depository system wef. Preferred stock is a special type of stock that pays a set schedule of dividends and does not come with voting rights. In my view both the bank IT sectors may face the heat this week but FMCG pharma may be a support.

For example for a balance over USD 1000000 the first 100000 is charged at the Tier I rate the next 900000 at the Tier II rate etc. An interest vested in this also an item of real property more generally buildings or housing in general. When calculating rates keep in mind that IBKR uses a blended rate based on the tiers below.

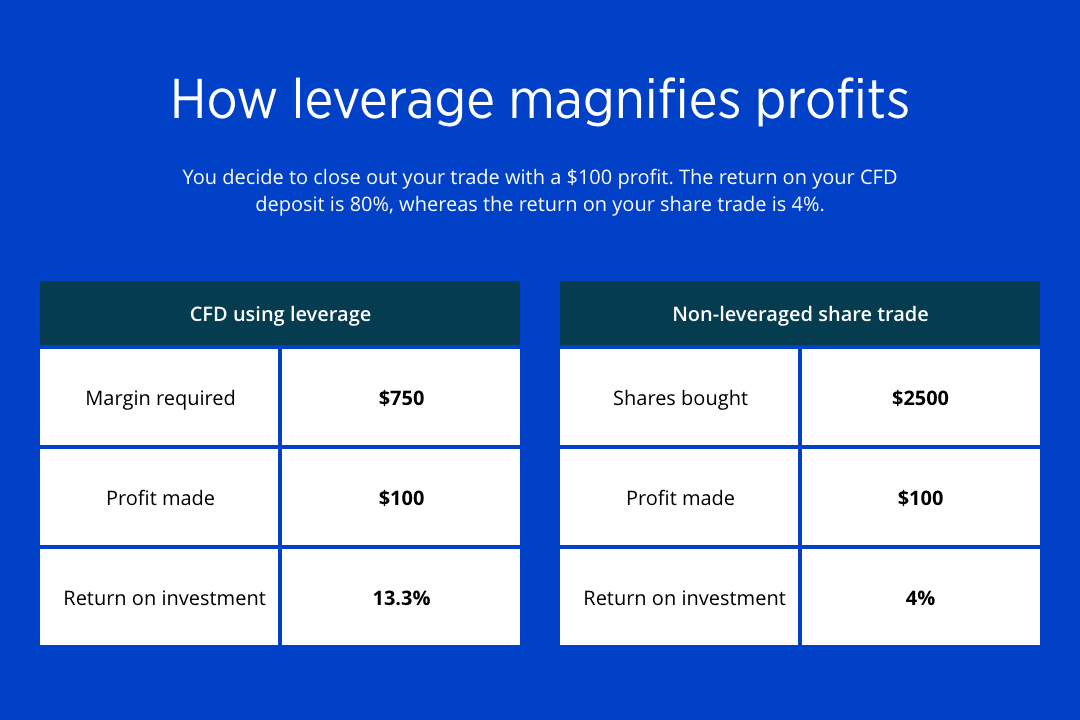

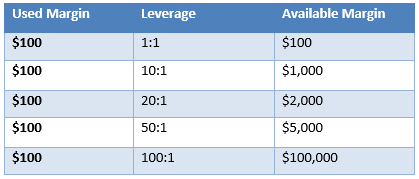

1 How much dollar value you should invest in based on your overall investment amount. As you can see leverage has an inverse relationship to margin. Its the perfect way to manage your trades and work out the position size and the leverage level you need to stick to.

The stock eventually rose to 2432 per share allowing the Oracle of Omaha to exercise those warrants for more than 17 billion reflecting a 12 billion gain on the original investment. Trading non-leveraged products such as stocks also involves risk as the value of a stock can fall as well as rise which could mean. The Margin Requirement is 001 or 1.

Leverage and margin refer to the same concept just from a slightly different angle. Update your mobile number e-mail ID with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge. If you are looking for a forex trading calculator trading calculator cryptocurrency forex profit calculator with leverage or forex power indicator we have tools that can help you with this.

You may insert your preferred askbid prices or let the calculator use the latest prices set by the market. Enter the instrument you wish to trade. 001 1 100.

Leverage is nothing more or less than using borrowed money to invest. Till now FIIs had been positive in cash markets but this may change with any negative news flow from global markets. Decide whether to buy or sell.

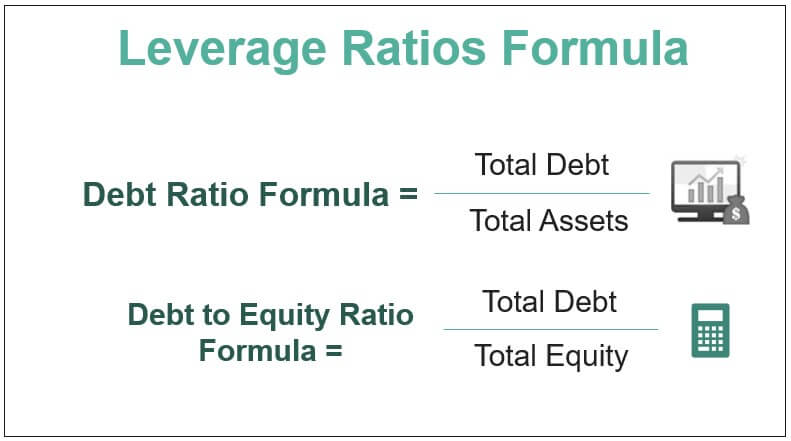

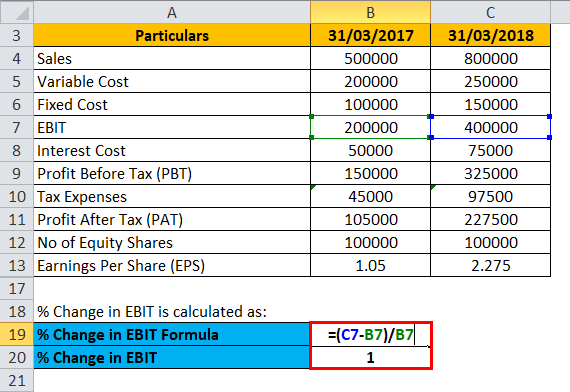

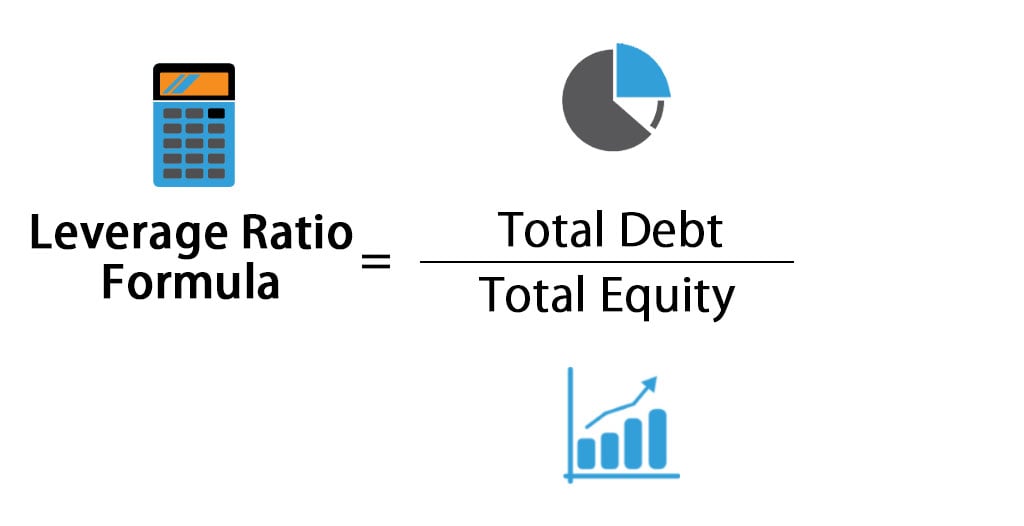

A stock market index tracks the ups and downs of a chosen group of stocks or other assets. Our financial leverage ratio calculator helps you to assess the riskiness of a company. The formula for a stock turnover ratio can be derived by using the following steps.

Interest Charged on Margin Loans View Examples. Common Stock Total Equity Preferred Stock Additional-paid in Capital Retained Earnings Treasury Stock. If you sell a call option and the option seller exercises it you need to buy 100 shares of the stock to sell to the person who holds the call.

If the stock price rises and all other variables remain unchanged then the price of the option will go down. Relevance and Uses of Common Stock Formula. This lets us find the most appropriate writer for any type of assignment.

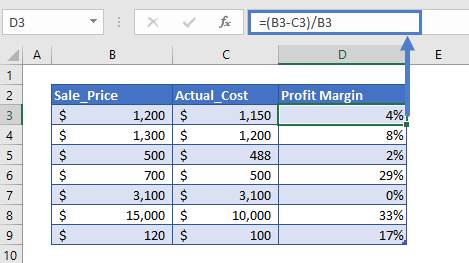

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The return on investment ROI and the break-even price. AvaTrades Trading Calculator will provide you with all of these risks of your next trade before you execute it.

GDP now hovers around 47 percent or nearly half the size of the economy. If the market value is 70 youll lose 2000. Explanation of Financial Leverage Formula.

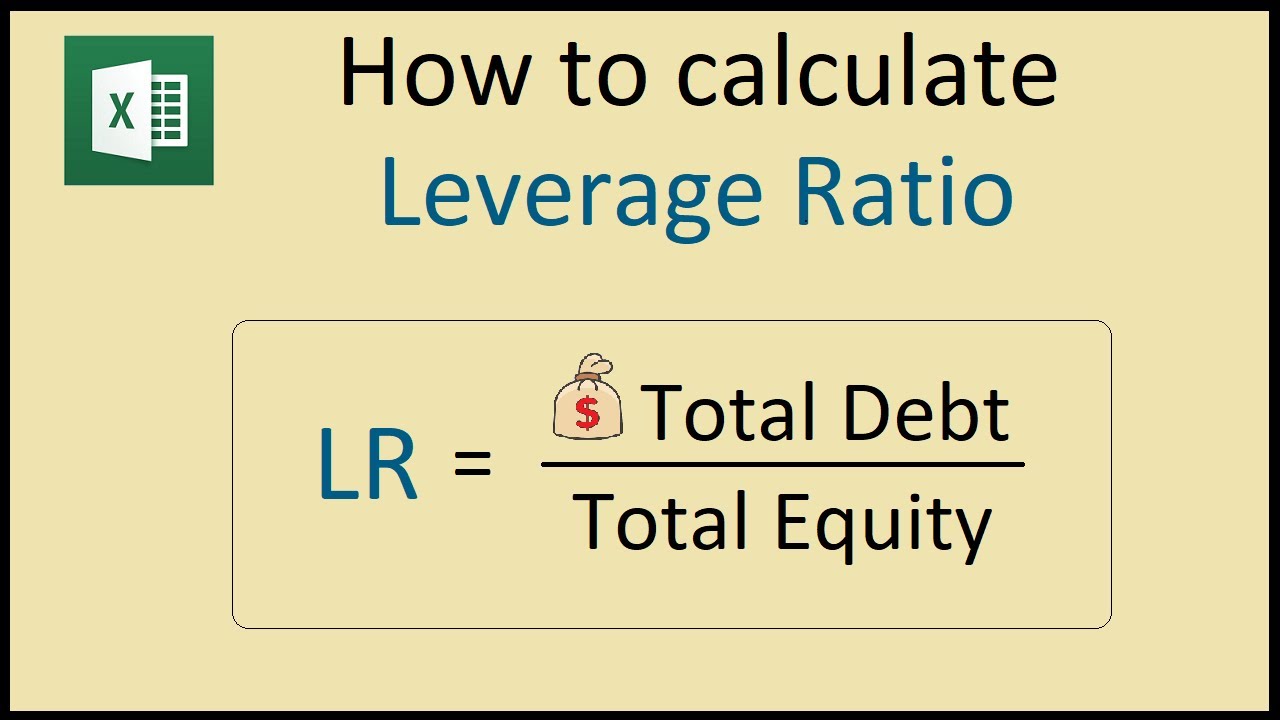

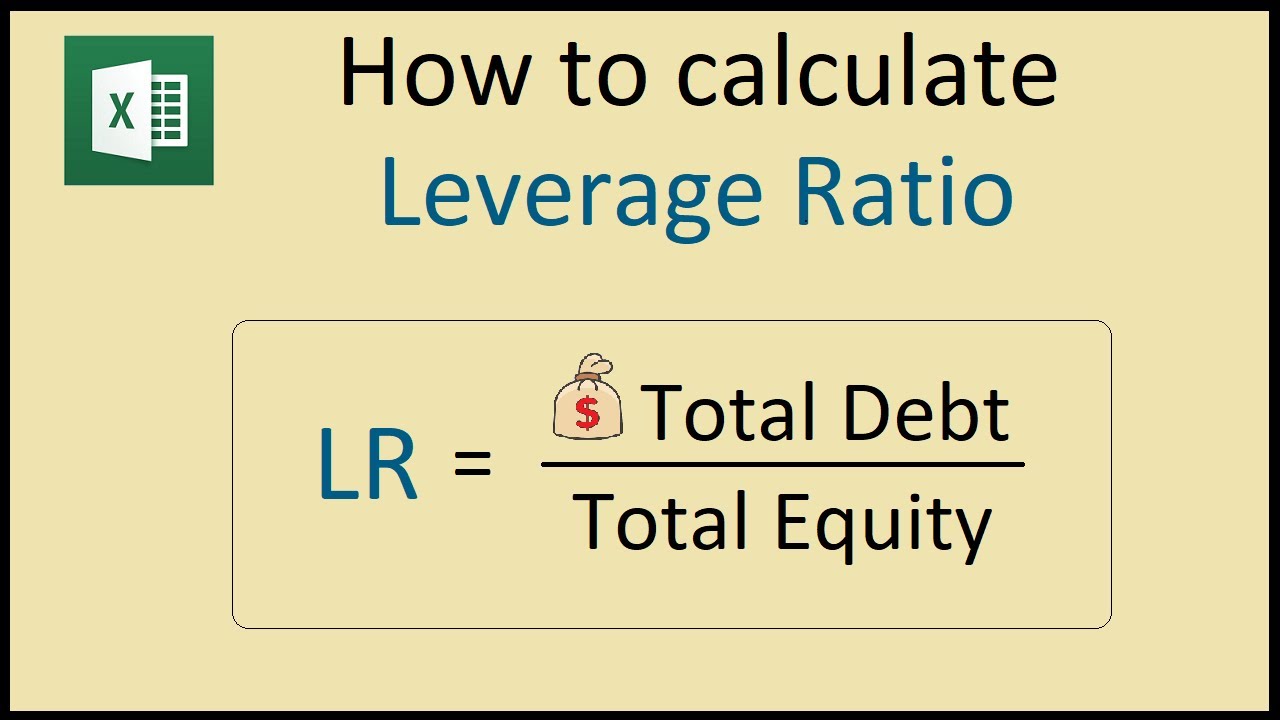

Margin Requirement 1 Leverage Ratio. Immovable property of this nature. By the time you sell the stock and pay the taxes youre losing 25 to 35 of the value says Kelly Elsensohn a wealth advisor and certified public accountant at WealthSource a national.

This stock profit calculator will also provide you with two important parameters. If the stock goes down 1. In terms of law real is in relation to land property and is different from personal property while estate means.

Check ask and bid prices. Leverage can be used to help finance anything from a home purchase to stock market speculation. The Margin Calculator is an essential tool which calculates the margin you must.

One of the most important aspects of risk management in leveraged trading is to be able to calculate your own margin requirement for each position you open in forex stocks and commodity trading. For example your leverage is 11000. Financial Leverage Formula works on the saying that the higher the ratio of debt to equity greater the return for the equity shareholders because with the higher proportion of debt in the capital structure of the company more financing decisions are taken through debt financing and lesser weighted is given to equity funding which results.

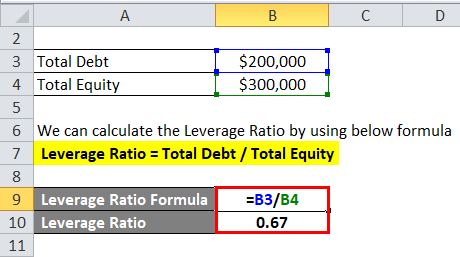

For example if the Leverage Ratio is 1001 heres how to calculate the Margin Requirement. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product. Watching the performance of a market index provides a quick way to see the health of the stock market and.

Finally select the platform you are trading on. Preferred stock combines aspects of both common stock and bonds in one. The common stock is very important for an equity investor as it gives them voting rights which is one of the most prominent characteristics of common stock.

In the overall series we are cautious about overall markets keeping broader geo-political risk in mind. There you have it.

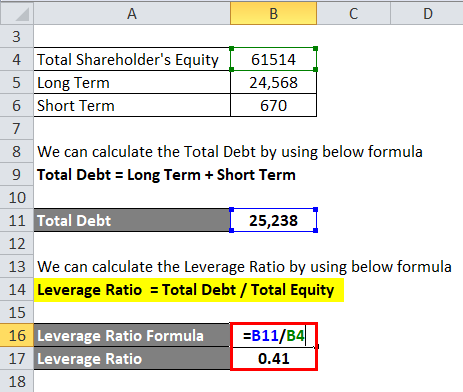

Leverage Ratios Formula Step By Step Calculation With Examples

Leverage Ratios Formula Step By Step Calculation With Examples

Margin Calculator Calculate Leverage Exposure For All Asset Classes

Financial Leverage Formula Calculator Excel Template

How To Calculate Leverage Ratio In Excel Youtube

Trading Scenario Margin Call Level At 100 And Stop Out Level At 50 Babypips Com

Cfd Leverage Explained Contracts For Difference Forex Com

Leverage Calculator Myfxbook

What Is A Margin Call Margin Call Formula Example

Profit Margin Calculator In Excel Google Sheets Automate Excel

Leverage Ratio Formula Calculator Excel Template

7 Best Free Online Financial Leverage Ratio Calculator Websites

Leverage Ratio Formula And Calculator Excel Template

Leverage Ratio Formula Calculator Excel Template

Leverage Ratio Formula Calculator Excel Template

Leverage Ratio Formula Calculator Excel Template

Leverage Ratios Formula Step By Step Calculation With Examples